The First Rule of Compounding

Podcasting has come in and out of my life in interesting ways.

I listened to my first podcast in July of 2012. I was on a bus, at midnight, in the middle of East Africa. My ever-steady travel partner Robin offered me an earbud connected to an orange iPod Nano (all headphones were wired back then).

I didn’t know what a podcast was. I was hook-line-and-sinker from the word go.

It was JRE #142. The Joe Rogan Experience was nowhere close to becoming the juggernaut it is today (and, although this may be something like heresy, it was very different then).

It was pure, unadulterated curiosity, broadcast from a basement.

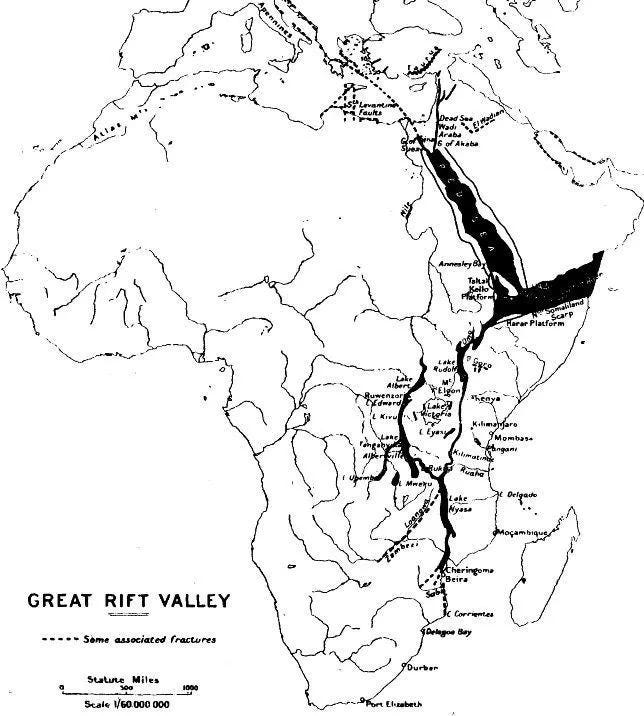

The guest was Graham Hancock and he told stories of possible ancient civilizations of the Amazon and early Christian origins in the Great Rift Valley in the Horn of Africa - not far, in fact, from where I found myself on that bus.

It was totally fascinating. As Craig Mod might say ‘…the mysterium tremendum.’ I remember thinking very clearly - this is the perfect medium.

A decade later, I look back at how my encounter with that podcast, on that bus, in that place has appeared in my life over and over.

It seems to me a story of the power of compounding. And there is nobody better on compounding than Morgan Housel.

I. The First Rule of Compounding

Compounding is hard to un-see. You may have first encountered the term in the world of finance - perhaps in Housel’s book The Psychology of Money.

The idea is to let your investments grow over time by not interrupting their ability to earn compound interest. Say you earn 8% on your principal investment this year, that then compounds at 8% year over year, until time takes over and you have a rather large number. That’s compounding.

Money needs time and it prefers to be uninterrupted.

The classic (probably now tired) example is Warren Buffet. After his philanthropic ventures, Buffet’s net-worth goes north of $100B. Housel points out that almost all of that princely sum is due to the simple fact that Warren has been investing, without interruption, for almost 80 years. He stayed in the markets and didn’t leave. More than 98% of his wealth was accumulated after his 65th birthday.

Small things eventually compound into big things, if allowed to do so. Compounding takes time.

“The first rule of compounding,” though, doesn’t come from Warren. It comes from his life-long business partner Charlie Munger. RIP sir.

The first rule of compounding is to never interrupt it unnecessarily. - Munger

II. Compounding in All Things

Compounding is easy to understand in finance, but it exists in all things.

It exists in relationships, it exists in physical and mental health, and it exists in what you choose to spend your time working on.

In our times it’s very in-vogue to crave excitement. Moving frantically from one hit of dopamine to the next. To sample lots of different potential paths or partners and then bounce around until one day you discover that thing you are meant to do or that person you are meant to be with.

But if compounding = consistency over a long period of time - isn’t the idea to put aside short-termism? Isn’t the real fruit found in not leaving that job for something better because you’ve had a bad month or quarter? In not finding a new partner because real relationships take hard work and vulnerability? In opting out of the night on the town, in favour of a slow, quiet walk at sunrise and breakfast with your kids?

We need help here. Our culture does not reward such behaviour.

Housel introduces us to Robert Weinberg, a cancer researcher at MIT. Weinberg is 80 years old and has worked in the same office at MIT for 51 years.

Some people say to me sometimes - how could you stay in one place for so long? … I have no regrets having been a stick-in-the-mud, having never really moved very far and working now only a couple hundred yards from where I was an undergraduate in the dorm at MIT. - Weinberg

Weinberg has no regrets, we can assume, because in all areas of life he let compounding take it’s course. Deep roots, life-long friends, colleagues who trust you and whom you trust, and a level of expertise in one domain that the rare few ever achieve.

Perhaps what we overrate in our quest for excitement and passion is depth. Depth is the natural effect that compounding has on a life well lived.

III. Analogous Domains Can Still Compound

Housel goes on to point out that Weinberg did say, if he had been working on the same thing for 51 years, boredom would likely have set in. But the domain of cancer research is so deep, there is virtually an infinite amount of things to learn and communicate.

And so, if we’re going to break the first rule of compounding in our professional lives, let us try to interrupt it in favour of an analogous domain. A domain where the benefits of compounding can still take place.

Allow me a personal example. It paints one possible picture.

From the outside, my professional life may look unique. From the inside, I see the waterways of my life very clearly - they make total sense in hindsight. I could have made better decisions, without question, but compounding is alive and well in my life.

My early days were spent in creative pursuit. I would dive head-long into books and then write about them. I could always write. It’s how I think and the medium I use to navigate the world. We all have 1 or 2 unique abilities that come from who-knows-where and writing is mine.

I would obsess over an old, tattered atlas or a copy of National Geographic - wanting to know and learn about the world’s places and their people. I was looking for patterns and I wanted to understand. I left home early, finding my feet in places like Greece, Turkey, East Africa, North Australia, and the south-western border region of Ecuador. Still, without question, in the pursuit of people and place, writing the whole time.

Ultimately, I didn’t expect to come home, until an opportunity presented itself in the immigration field. I expected to leave where I was born - where all of my early relationships were - and go out to the world to find compounding elsewhere. Now, the world was coming to me. My formerly homogenous hometown was embarking on a diverse future. Something I deeply believed in and wanted to be a part of (although I was naive about the details).

Working in immigration is ultimately about trying to help bring about good settlement outcomes, and for the first years of my career I did just that. The looming question was - can our city be a place where talented, productive immigrants come and live a happy, productive life?

Economic opportunity is their first priority - always. One way to ‘unlock’ economic opportunity is to create your own opportunity - and so for the following two years I ran and built entrepreneur development programs for immigrants.

Entrepreneur development is an interesting business. You’re going back to the basics. Entrepreneurs spot a problem, something that doesn’t work quite right, they work to understand the human experience of that problem in the real world and then build and sell a solution.

In December 2021, the man who would become my mentor asked me if I would come and build an entrepreneur development project with him - still with a group of highly diverse, talented founders. Believing in our relationship and the power of my network, I agreed, and we’ve been working on that project ever since.

There will be deviations. You will make mistakes. You’ll unintentionally burn bridges and lose relationships. You will be forced to act, and then to own the outcomes of those actions. You will use, build and eventually leverage your own judgement. You will crave jumping ship and, at times, may even go overboard.

But the first rule of compounding remains…never interrupt it unnecessarily.

"It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent."

- Charlie Munger

See you on the path.

MG

Well stated Matt!